Summerhall, a beloved culture venue in Edinburgh, was threatened with closure earlier this year, and has now received a winding-up petition from HMRC over unpaid corporation tax.

Summerhall, a beloved culture venue in Edinburgh, was threatened with closure earlier this year, and has now received a winding-up petition from HMRC over unpaid corporation tax.

The founder of Summerhall is contesting the order, arguing that the tax is only owed on profits.

After being put up for sale in May, the charity operating Summerhall was granted a three-year lease to continue at the site.

Robert McDowell, who has managed the venue since 2011, stated that the management plans to fight the case, though the situation may impact the operations of some areas within the venue, which hosts over 100 businesses, including a brewery and a cinema.

McDowell argued that Summerhall Management Ltd believes no corporation tax is owed to HMRC, emphasising that the tax applies to trading profits, investments, and asset sales.

Should the tax remain unpaid, HMRC could pursue a winding-up petition, potentially leading to liquidation.

McDowell noted that the venue is currently operating under strict guidelines that might affect some tenants, assuring that they are communicating with those impacted.

The petition comes just three months after Summerhall secured its new three-year lease, even as its owners, Oesselmann Estates, considered selling the property, with potential plans for redevelopment into a boutique hotel or student accommodation.

The charity Summerhall Arts was established to oversee events at the venue, which includes exhibition spaces, galleries, theatres, and outdoor areas.

A closing date for the sale was previously set for September 18th, but it remains unclear if any offers have been made.

Trump makes history as the first sitting President to attend a Super Bowl

Trump makes history as the first sitting President to attend a Super Bowl

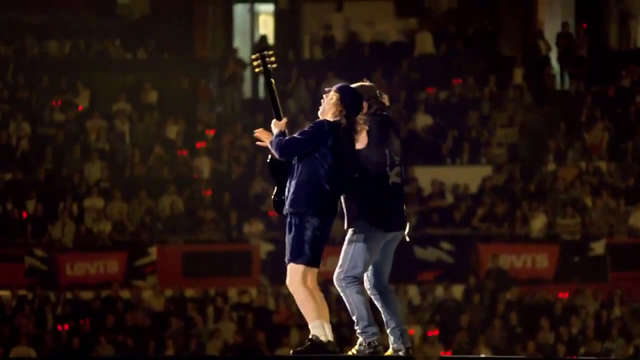

AC/DC to rock Edinburgh this summer

AC/DC to rock Edinburgh this summer

Police warn public to avoid Callendar Park in Falkirk due to suspicious behaviour

Police warn public to avoid Callendar Park in Falkirk due to suspicious behaviour

Scotland Kicks Off its Six Nations Campaign

Scotland Kicks Off its Six Nations Campaign